It’s Not All Bad…

Last week, the Dow experienced its worst week in 112 years of history.

And yet, it’s not all bad. There are many opportunities to be taken advantage of. You only have to have the eyes to see them.

Here’s an example…

Imagine the most difficult business you could possibly be in at the moment. The one segment of the economy that is hurting the most.

I’m currently in that market… and with a single direct mail letter plus a single broadcast email, we’ve produced nearly 50 inquiries with combined MONTHLY volume of more than $40 Million.

If even half of these inquiries become clients, it will produce $240 Million of ANNUAL volume for my client. (Key word is volume, not profit.)

For the online piece of the equation, we’re using a forced opt-in combined with a sales letter. After a prosect opts in, he is taken to a “thank you” page that instructs him to go to his inbox and confirm his request.

After the prospect confirms his email subscription, he is automatically taken to the sales letter. The sales letter is not that long… maybe five pages or so. It asks the prospect to turn over his name, email, address, phone, and some additional details about his business.

To drive traffic to the opt-in page, we sent a single broadcast email to a cold list. It wasn’t an endorsed mailing — it was a broadcast to people we’ve never met nor talked to before.

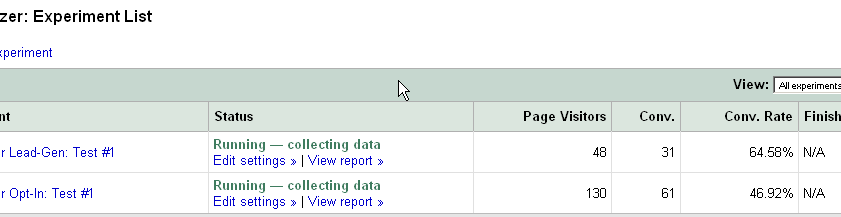

So far, 46.92% of page visitors are opting in to the list. Of those, 64.58% are giving us ALL their information in order to be contacted by a sales person.

Basically, this means that if we send 100 people to the page, 30 will become “hot leads” — leads that have completed all the steps.

Here’s the screen shot of the test results to date:

And remember: this is the WORST business I can possibly imagine being in at this moment.

So while you should be aware of what’s happening in the economy, you should also have your “opportunity sensors” set to high sensitivity.

Even in the midst of hardship, opportunity abounds.

-Ryan M. Healy

P.S. I’ve got an in-depth article planned for Tuesday, October 15. It’s called “Business Growth in Hard Times.” Make sure you check back on Tuesday.